“How will we pay for it?” That is their question.

This past month, I recommended The Deficit Myth, Modern Monetary Theory and the Birth of the People’s Economy, by Stephanie Kelton (2020), in my “Great Reads for Our Times – with a Dose of Hope” blog. I received some push back, and I felt compelled to find out everything I can about how money really works in our government.

The reason for this compulsion is that, in addition to wanting the US to treat other people well around the world, in this country I would dearly love to see a real Green New Deal to address the climate crisis and jobs, and to have an improved Medicare for All to achieve universal healthcare. A growing majority of people agree.

What about state and local finance? Localities and states do have to balance their budgets, like households, but unlike Uncle Sam. To help us thrive and not sink into austerity, I’ve been an advocate for taxing the rich since I can remember (more on tax later), and an advocate for public banking since 2010. Imagine investing in our states and local communities, not Wall Street.

What about the nation’s finances? Here’s what I’ve learned.

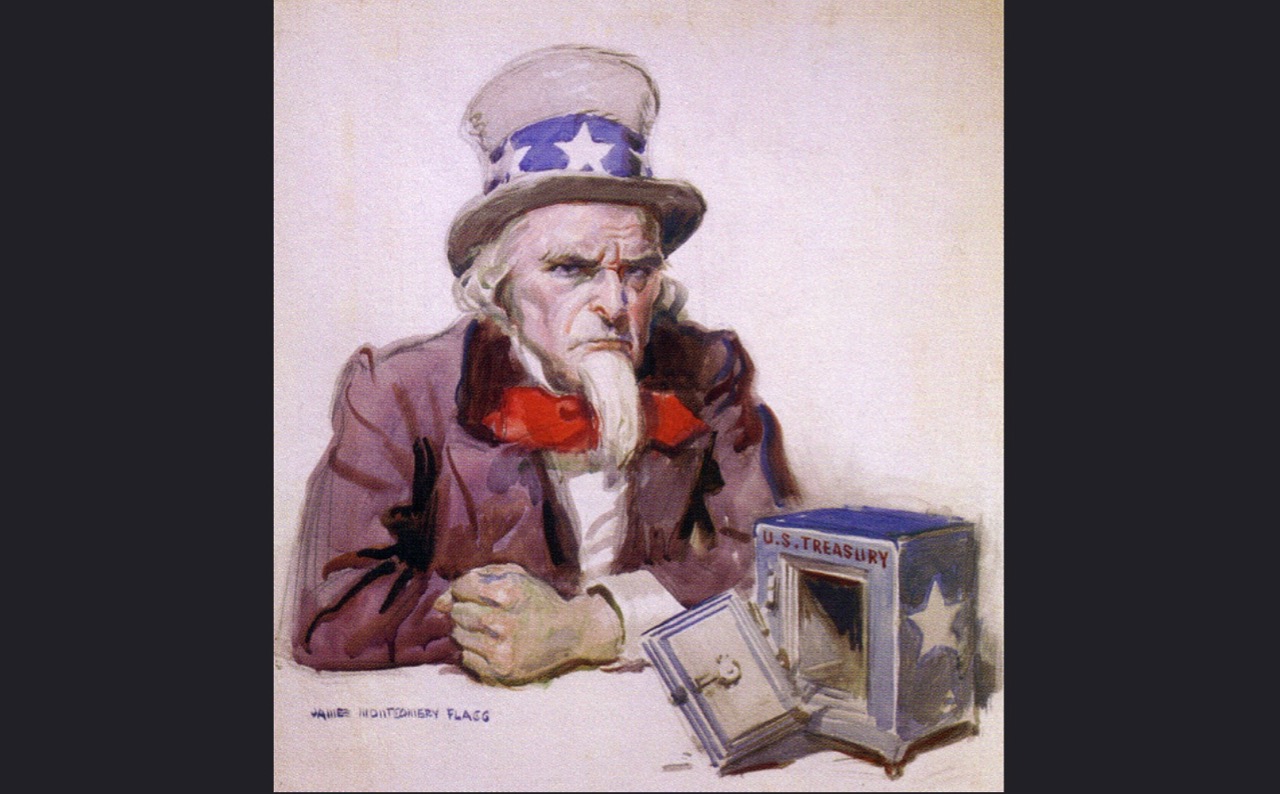

1. Evidence abounds in our own lifetimes that Uncle Sam has all the money he wants, when he wants it. Here are just a few of the examples; I’m sure you can think of more.

• The pandemic hit. Suddenly trillions of dollars appeared to be posted to people’s bank accounts to serve as economic stimulus.

• Trump tax cuts — benefiting primarily the wealthy and their corporations — sailed through Congress without apparent concern about budget deficits or getting the money from some other place.

• The subprime mortgage/global financial crisis hit. Suddenly there were billions and then trillions of dollars to bail out the “too big to fail” Wall Street banks — which by the way had caused the crisis.

From these examples and more, we can acknowledge that the US government “creates” all the money it wants, when it wants it.

2. Uncle Sam cannot “run out of money.”

— The national budget is not like a household budget, mainly because the US issues the currency it spends. It is a “currency issuer” not a “currency user.” In the 1970s the US changed into a fiat currency backed by the US government itself, not on gold bars stacked in Fort Knox. That changed how money works.

— Alan Greenspan has confirmed, “There’s nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”

3. But there are limits. Uncle Sam cannot just “print money” at will with no consequences.

— A limit is inflation.

— An article with a great summary of the ideas in Stephanie Kelton’s book pointed out, “If creating new money out of thin air creates inflation, why was there no inflation when Ben Bernanke created $1 trillion in assets to save the banks during the financial crisis?”

— The budget deficit increased then, but inflation did not. In fact, in 2009 Paul Krugman said, “That’s an interesting way to think about what has happened – and it also suggests a startling conclusion: namely, government deficits, mainly the result of automatic stabilizers rather than discretionary policy, are the only thing that has saved us from the second Great Depression.”

— Basically, when the economy is sunk, “new money” can be pumped into it without causing inflation. This is especially true when the new money is in the form of a New Deal-style jobs program that kicks in automatically when unemployment is high – an “automatic stabilizer.” This new money can expand the economy and help repair “deficits that matter” such as deficits in jobs, healthcare, education, infrastructure and the environment.

4. Yes, we do need to reduce military spending, for lots of human and climate reasons, and we need to tax the rich because, quoting former Supreme Court Justice Louis Brandeis, “We must make our choice. We may have democracy, or we may have wealth concentrated in the hands of a few, but we cannot have both.” It is important to understand and to argue, however, that we don’t have to wait until after Congress takes action on the military or taxes. We can pay for things regular people want and need now.

5. “You can’t trick us any more!” The more that people know how US money really works, and can point to the examples that prove it, the more we can argue back…

…when they ask, “How are you going to pay for it?”

…when they declare, “There’s no money for the Green New Deal or Medicare for All,”

…when they falsely claim, “Social Security will run out of money before the next generation reaches retirement age.”

6. A triumph of imagination. The last chapter of The Deficit Myth describes the contrast between what we have now – austerity, trade wars, and ecological exploitation – and what we could have. Stephanie Kelton writes, “Austerity is a failure of imagination – the failure to imagine how we can simultaneously improve living standards, invest in our nation’s future, maintain a healthy economy, and manage inflation. Trade wars are a failure of imagination – the failure to imagine how we can simultaneously maintain domestic full employment, help poor nations sustainably develop, lower our global carbon impact, and continue to enjoy the benefits from trade. Ecological exploitation is a failure of imagination – a failure to imagine how we can simultaneously improve living standards, maintain a prosperous economy, and transition human activities so that we are protecting people and the planet.”

In this age when so much needs to be done now, we need to break through the false obstacles. In the references below you will find fascinating information that will expand on this attempt of mine to briefly describe how US money really works.

FOR MORE INFORMATION

NOTE: Most money is never “printed.” Read here to see that (in late 2011) “…actual cash comprises a bit more than 10.2 percent of the total money. This means that almost 89.8 percent of the money in the United States is not in the form of cash.” Personally, I still find it a little mind-bending to hear economists say money is created using keystrokes to make entries in financial accounts, as when a bank makes a loan, or Congress authorizes the Fed to make a payment. Mine-bending, but true!

The Deficit Myth, Modern Monetary Theory and the Birth of the People’s Economy, by Stephanie Kelton (2020)

Watch the first 2 minutes of The Real News interview for a good, very quick summary:

https://therealnews.com/modern-monetary-theory-a-debate-randall-wray-pt-1-4

Listen to this interview that includes a fascinating global perspective by Tunisian/Saudi Arabian/American Fadhel Kaboub: mronline.org/2018/07/07/the-new-postcolonial-economics-with-fadhel-kaboub

Read “MMT: Here’s a plain-English guide to ‘Modern Monetary Theory’ and why it’s interesting” https://www.businessinsider.com/modern-monetary-theory-mmt-explained-aoc-2019-3